Complete Guide to YMAX Dividend History: Trends, Growth, and Insights

YMAX dividend history is an important topic for investors who want to understand how this fund has performed over time. Many people look at dividend history to see if a stock or fund can give steady income. By checking YMAX dividend history, investors can get a clear idea of its payout trends, growth patterns, and stability. Dividends are not just extra income—they reflect how well the company or fund manages its profits and shares them with investors. For anyone planning long-term investments, knowing YMAX dividend history helps make better decisions. You can track when dividends were paid, how much they were, and if the payouts have grown steadily. This information is very helpful to both new and experienced investors who want to maximize returns while keeping their investments safe.

YMAX dividend history shows patterns that can guide future investment decisions. Over the years, investors have used dividend data to predict potential growth and understand risk levels. By reviewing past dividends, you can see which periods had higher payouts and which had lower ones. This can indicate how market conditions or fund strategies affected earnings. YMAX dividend history also helps in comparing it with other funds or stocks in the same category. Consistent dividends often attract investors who prefer reliable income, while variable payouts may signal market challenges or management changes. Understanding the timing and amount of each dividend is key for planning reinvestments or retirement income. Overall, analyzing YMAX dividend history provides a valuable roadmap for smart investing, helping investors make informed choices and reduce surprises in their financial journey.

Understanding YMAX Dividend History: What Investors Need to Know

YMAX dividend history tells investors about the money the fund has paid over time. It is important to look at both the amount and frequency of dividends. Some funds pay quarterly, others monthly or annually. Knowing this helps investors plan their finances. By checking YMAX dividend history, investors can see if the fund has regular payments or if it changes a lot. A stable history shows that the fund is reliable and can be trusted for consistent income.

How YMAX Dividend History Shows Payout Trends Over Time

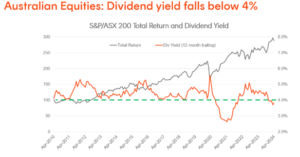

Studying YMAX dividend history helps identify trends. For example, some years may have higher payouts, while others may be lower. Trends can indicate how market conditions or management decisions affected dividends. Investors can use these patterns to predict future payouts and make better investment choices. Tracking trends is also helpful when comparing YMAX with similar funds to see which one is more stable or profitable.

Key Years in YMAX Dividend History That Shaped Returns

Certain years in YMAX dividend history are more important than others. High payout years might coincide with strong market performance, while lower payouts could reflect challenges or downturns. Identifying these years helps investors understand how the fund responds to different market conditions. This knowledge is useful for long-term planning and evaluating the fund’s performance compared to its peers.

YMAX Dividend History: Comparing High and Low Payout Periods

YMAX dividend history includes both high and low payout periods. Comparing these periods gives insight into the fund’s stability. High payouts attract income-focused investors, while lower payouts may suggest caution. Understanding the reasons behind these changes, such as market events or fund strategy shifts, helps investors make smarter decisions.

Why YMAX Dividend History Matters for Long-Term Investors

Long-term investors benefit from knowing YMAX dividend history because it helps plan future income. Consistent dividends mean investors can rely on regular cash flow, which is important for retirement planning or reinvesting. YMAX dividend history also shows if the fund can maintain its performance over time. Investors who ignore dividend history may miss important clues about risk and potential growth.

Insights from YMAX Dividend History for Retirement Planning

Retirement planning requires a focus on steady income and low risk. YMAX dividend history provides valuable information for this. By knowing the amount and consistency of past dividends, investors can estimate future income. They can also decide whether to reinvest dividends or use them as cash flow. A solid dividend history makes YMAX a potential option for retirement portfolios.

Tracking YMAX Dividend History: Tools and Resources

Investors can track YMAX dividend history using online tools and official fund websites. Many financial portals provide detailed dividend data, including dates and amounts. Tools like investment apps, financial news websites, and fund reports make it easier to stay updated. Keeping a record of YMAX dividend history is useful for analyzing trends and planning strategies.

YMAX Dividend History vs. Other Funds: What’s the Difference?

Comparing YMAX dividend history with other funds helps investors see which fund offers better stability and growth. Some funds may have higher dividends but irregular payouts, while YMAX may provide consistent income. Looking at these comparisons helps investors choose funds that match their goals, whether for steady income or long-term growth.

How Market Changes Influence YMAX Dividend History

Market conditions, interest rates, and economic events affect YMAX dividend history. Strong markets often result in higher dividends, while downturns may reduce payouts. Understanding this connection helps investors manage expectations and plan their portfolios. YMAX dividend history shows how resilient the fund is during different market conditions.

YMAX Dividend History and Reinvestment Strategies

Many investors use dividends to reinvest and grow their wealth. By studying YMAX dividend history, investors can decide the best times to reinvest. Reinvesting dividends can increase long-term returns, especially if the fund has a consistent payout record. YMAX dividend history helps in making these decisions more confidently.

Common Mistakes Investors Make Ignoring YMAX Dividend History

Some investors ignore dividend history and focus only on price growth. This can be risky because dividends are a major part of total returns. By ignoring YMAX dividend history, investors may miss opportunities for steady income or misjudge risk levels. Understanding past dividends ensures smarter investment planning.

Future Outlook Based on YMAX Dividend History Trends

YMAX dividend history provides a roadmap for the future. Consistent trends suggest stability, while fluctuating patterns indicate potential risks. By analyzing these trends, investors can estimate future payouts, plan reinvestment strategies, and make informed decisions about including YMAX in their portfolios.

Conclusion

YMAX dividend history is a key resource for investors seeking reliable income and long-term growth. By studying past dividends, investors can understand payout trends, plan reinvestments, and manage risk. Consistent dividends reflect stability and strong fund management, making YMAX a potential option for income-focused investors. Paying attention to YMAX dividend history helps in making smarter investment choices and building a stronger financial future.

FAQs

Q1: What is YMAX dividend history?

A: YMAX dividend history shows the record of all past dividend payments made by the fund, including amounts and dates.

Q2: Why is YMAX dividend history important?

A: It helps investors understand payout consistency, plan income, and compare the fund with others.

Q3: How often does YMAX pay dividends?

A: YMAX usually pays dividends quarterly, but this can vary depending on fund performance.

Q4: Can dividend history predict future payouts?

A: While past performance is not a guarantee, dividend history helps identify trends and estimate potential future payouts.

Q5: How can I track YMAX dividend history?

A: Investors can track it using the fund’s official website, investment apps, and financial news portals.